Search

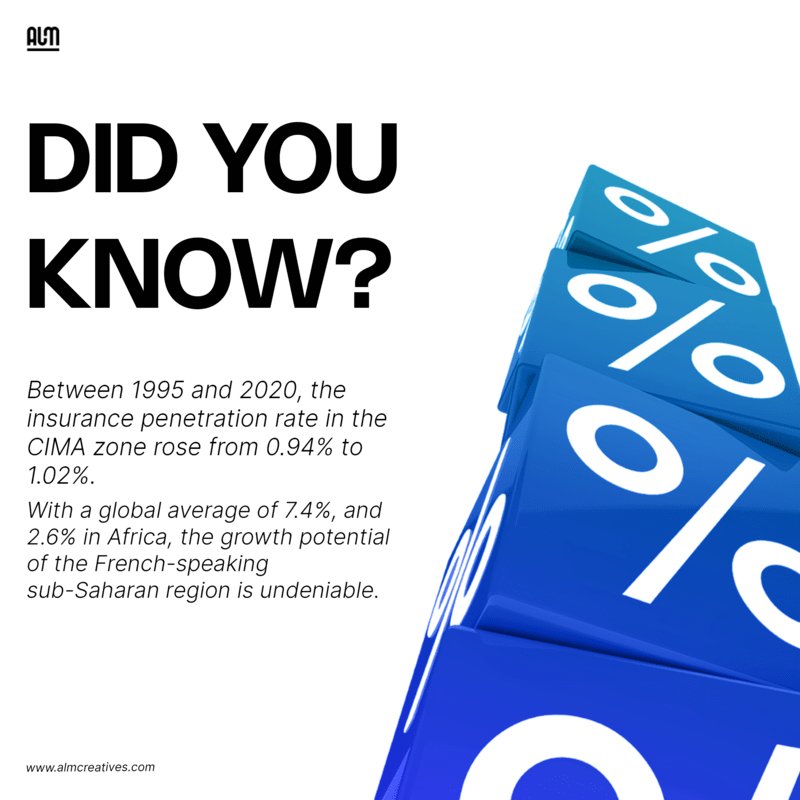

Insurance Penetration in CIMA Zone: Growth Potential and Regional Disparities

Business and advices

The insurance penetration rate in the CIMA zone, comprising West and Central African countries, has seen limited progress over the past 26 years.

This article examines the disparities in insurance market development across the region, highlighting the growth potential and regulatory changes that could shape its future.

Insurance Penetration Rates in CIMA Zone

Over the period of 1995 to 2020, the insurance penetration rate in the CIMA zone marginally increased from 0.94% to 1.02%. This remains well below the global average of 7.4% and the African average of 2.6%.

Notably, premiums as a percentage of GDP vary significantly, ranging from 1.69% in Togo to 0.14% in Guinea Bissau, indicating varying levels of insurance market development within the CIMA zone.

Regional Variation in Insurance Penetration

Insurance penetration rates across Africa demonstrate substantial variation. South Africa leads the continent with a rate of 13.7%, ranking 4th worldwide after Hong Kong, Taiwan, and the Cayman Islands. Morocco follows with a rate of 4.5%, while Tunisia stands at 2.3%.

However, countries like Algeria, Egypt, and Nigeria exhibit lower rates of 0.8%, 0.7%, and 0.3% respectively, highlighting the disparities in insurance market development across Africa.

Factors Influencing Insurance Penetration

Disparities in insurance penetration can be attributed to several factors, including variations in economic development, access to financial services, and levels of financial literacy. In some countries, insurance is considered a luxury and does not receive prioritization due to competing financial needs.

Growth Potential in the CIMA Zone

The relatively low insurance penetration and density rates in the CIMA countries indicate significant growth potential within the region. With a young population of 187 million, many of whom belong to a rapidly emerging middle class, the demand for insurance is expected to rise.

Regulatory Changes and Future Development

Regulatory changes introduced by CIMA, coupled with the anticipated economic recovery, are expected to drive future growth in the CIMA zone's insurance industry. These changes, combined with increased demand, are likely to result in the availability of affordable and accessible insurance products tailored to the needs of low-income households and small businesses.

Conclusion

While the insurance penetration rate in the CIMA zone remains relatively low, the presence of growth potential, regulatory changes, and the emerging middle class suggest a promising future for the insurance industry in the region.

As economic development progresses and financial literacy improves, the insurance market is poised for significant expansion and increased accessibility.